|

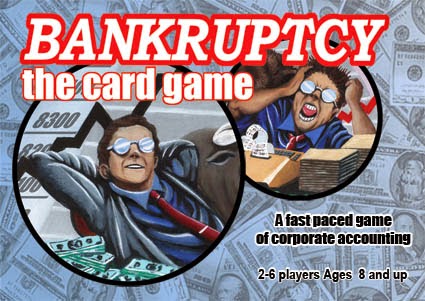

| Yes, this is a real game. Credit: Tangent Games, http://www.tangent-games.com/bankruptcy.html |

Usually, you don't need a lawyer to deal with your bankruptcy. You'll definitely need a trustee in bankruptcy. But you should be aware that unlike a bankruptcy and insolvency lawyer who ethically is completely devoted to your interests, a trustee acts more like a privately employed government agent.

You pay for the trustee (which can sometimes be an issue for people who don't have any money), the trustee will gather together information on your debts and assets that you provide to the trustee, and then processes your bankruptcy application (or your proposal to creditors). But sometimes the trustee will oppose your discharge from bankruptcy because the trustee claims you haven't complied with the required conditions, and at other times some of your creditors may oppose the discharge (like a bank or or Canada Revenue Agency). In that kind of situation, you should consider hiring a bankruptcy lawyer.

If you're a creditor, you might also need a lawyer to pursue your debts against a bankrupt, because sometimes a trustee in bankruptcy could disagree with how much your debt is worth, and claim that it is an unsecured instead of secured debt. Ultimately, it's the bankruptcy court judge, and not the trustee, who decides upon how much you are entitled to out of the bankrupt's estate. Unfortunately, the arguments over mortgage clause interpretation, debt priorities, and validity of promissory notes can get quite legalistic, so a lawyer may be justified.

On the plus side, it's usually possible to get a fairly quick hearing in bankruptcy court (at least in Ontario) compared to wait times for other courts, and hearing are usually over in under a day so legal costs will usually be manageable.

No comments:

Post a Comment